White Label Digital Lending Platform

Catalyzing banks and fintechs reach out to the unbanked for financial access.

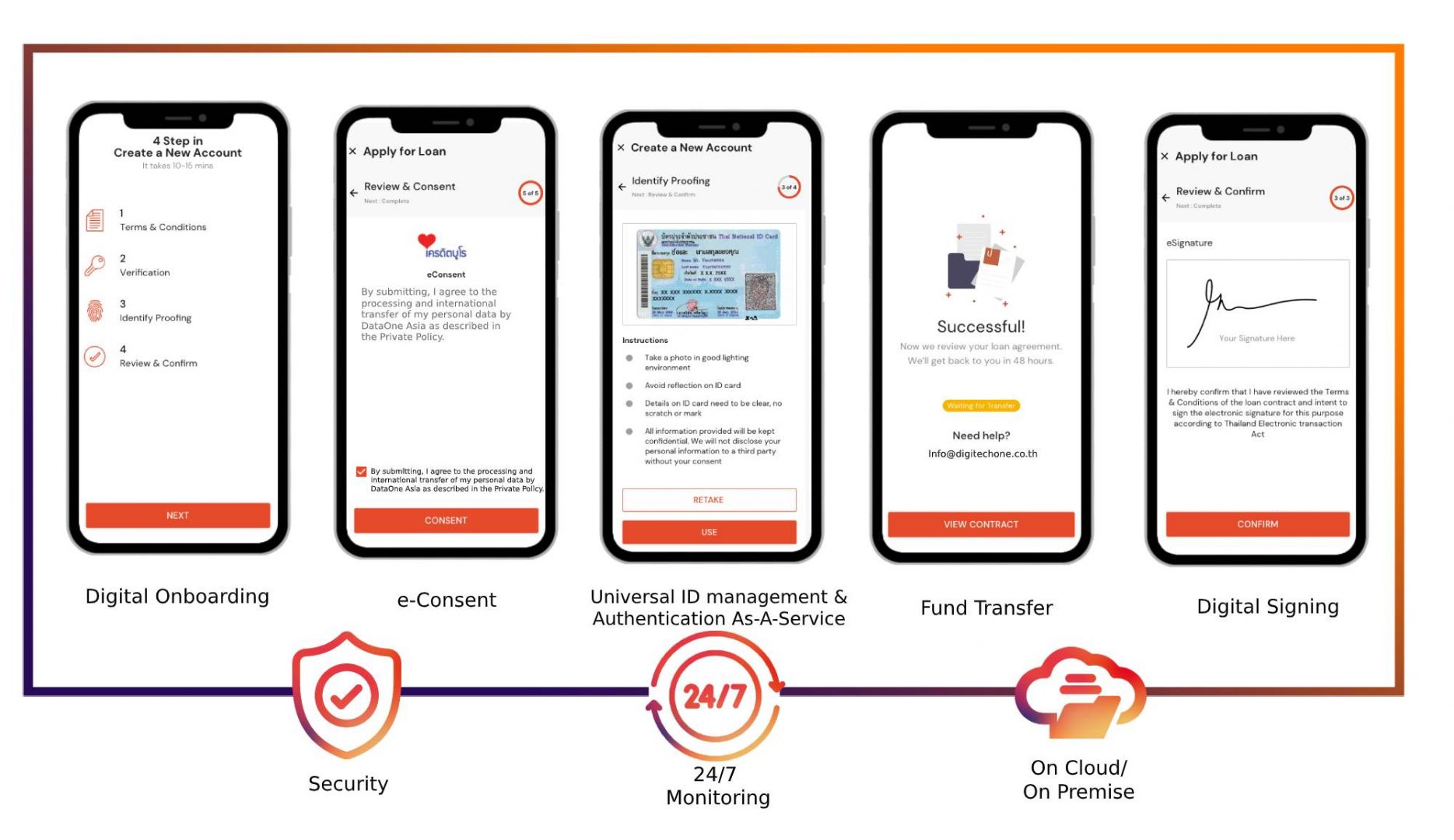

Mobile has become the most integral part to reach out to the underbanked. The cost of traditional ways of customer acquisition is too high and outdated. Digitech One has orchestrated all the services financial institutions need to digital lending services. From the e-KYC module, Open API for product management module, e-consent module, fund transfer API to sponsored banks and electronic signature API for a loan contract.

We follow the international guideline such as NIST SP 800-63 Digital Identity Guidelines and ETDA’s Digital Identity Guideline for Thailand.

White Lable Mobile Lending

How does it work?

Benefits

Easy onboarding for customerWe help enterprise onboard customers to

|

|

|

|

|

Contact our expert

By submitting, I agree to the processing and international transfer of my personal data by DataOne Asia as described in the Private Policy.